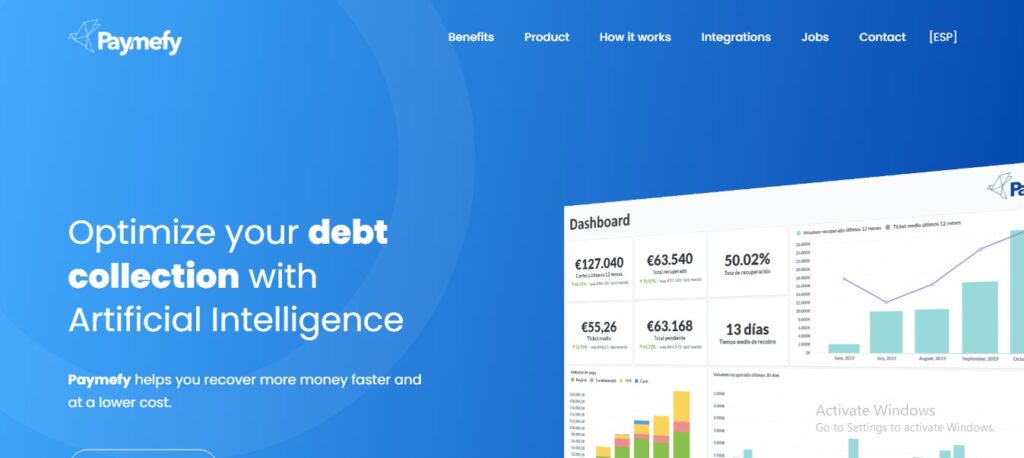

Paymefy: Optimize Debt Collection with AI

Paymefy is an AI-powered debt collection platform that helps businesses automate and optimize their debt recovery processes.

Description

Paymefy is an AI-powered debt collection platform that helps businesses automate and optimize their debt recovery processes. By leveraging machine learning and intelligent workflows, Paymefy aims to increase recovery rates, reduce costs, and improve efficiency in managing outstanding invoices.

Detailed description:

- Paymefy integrates with your existing CRM or accounting software to access outstanding invoices.

- It uses AI to create personalized communication workflows, targeting customers with the right message at the right time through various channels (email, SMS, WhatsApp).

- The platform offers a one-click payment solution that simplifies the payment process for customers, encouraging faster debt settlement.

- It provides real-time monitoring and analytics, allowing businesses to track progress and identify potential issues.

- Paymefy automates tasks like sending reminders, escalating cases, and generating reports, freeing up valuable time for your team.

Key features and functionalities:

- AI-powered communication workflows

- One-click payment solution

- CRM and accounting software integration

- Multi-channel communication (email, SMS, WhatsApp)

- Automated reminders and escalations

- Real-time monitoring and analytics

- Customizable communication templates

- Secure data handling and compliance

Use cases and examples:

- Businesses with outstanding invoices: Automate debt collection processes and improve recovery rates.

- Financial institutions: Streamline debt recovery operations and reduce manual effort.

- Collection agencies: Enhance efficiency and effectiveness in managing debt portfolios.

- E-commerce businesses: Recover unpaid orders and reduce cart abandonment.

- Subscription-based businesses: Manage recurring payments and reduce churn.

Examples:

- A small business uses Paymefy to automate reminders for overdue invoices, improving cash flow and reducing the need for manual follow-up.

- A collection agency uses Paymefy to create personalized communication strategies for different customer segments, increasing the likelihood of successful debt recovery.

User experience:

While Paymefy focuses on simplifying recurring payments, its design and features suggest a user experience that prioritizes:

- Efficiency: Automating payment processes to save time and reduce manual effort.

- Convenience: Providing a user-friendly platform for managing recurring subscriptions and bills.

- Security: Ensuring secure transactions and protecting sensitive financial information.

Pricing and plans:

Paymefy offers flexible pricing plans based on usage and features.

Contact Paymefy for a personalized quote and to discuss your specific needs.

Competitors:

- Collectly: An AI-powered debt collection platform with a focus on healthcare providers.

- TrueAccord: A debt collection platform that uses machine learning to personalize communication.

- Uplift: A platform that offers payment plans and financing options to help customers manage debt.

Paymefy's unique selling points:

- Focus on automating and optimizing debt collection with AI.

- One-click payment solution for simplified debt settlement.

- Multi-channel communication and personalized workflows.

- Real-time monitoring and analytics for data-driven decision-making.

Last Words: Improve your debt collection process with Paymefy! Visit the website to learn more and request a demo.